THE ESSENTIALS OF HOW LONG TO PAY OFF STUDENT LOANS Do you know how long it will take to pay off your student loans?

happy news You’ve arrived at the proper location.

Be aware that everyone’s student debt situation is a little different before diving into the specifics. While some of you may have only used the government loans that were offered, others may have had private loans with different terms. It’s critical to comprehend your current circumstance in order to determine how long it might take you to pay off your student loans.

How long student loans must be repaid: federal assistance Your loans will enter a period known as a grace period once you stop being a full-time student (which includes finishing college). You won’t be required to make any student loan payments during this time for a period of six months. It’s a fantastic opportunity for you to land a job and establish yourself before the bills start to pile up.

It’s time to start repaying your loan once your grace period has expired. The federal government has a few different repayment options :

Standard: Students who select this option will make the same payment each month until their loan balance (plus any additional interest) is fully repaid. How long will it take for this plan to pay off student loans? 10 years . Keep in mind that you can always pay more than the required minimum to pay off your loans sooner. Graduated: This option enables students to begin their repayment with lesser payments and increase their payments over time. The minimum payment required for anyone who selects this option will increase every two years. Once more, the repayment period for the loans under this arrangement will be 10 years. If you have more than $30,000 in Direct Loans, you may be eligible for the extended repayment plan. Remember that extending your payments will result in you paying a lot more interest over time. How long does extended repayment for student loans last? 25 years . Once more, if you have the resources to pay off your loans early, you should.

In order to qualify for income-based repayment (IBR), you must provide proof of a financial hardship. To be qualified, you’ll probably need to present documents or proof of any income. If approved, you can anticipate that your payments will represent roughly 15% of your discretionary income. Students have 25 years to make payments under this repayment plan. Following that period, any outstanding debt is forgiven to the student. Similar to the IRB plan, the Pay as You Earn option also requires proof of financial hardship, but the monthly payments are merely 10% of discretionary income. Borrowers can anticipate paying for 20 years instead of 25 in another distinction. Any outstanding debt will be forgiven following 20 years of payments. Dependent on Income – The number of people in your home, your yearly income, and whether you receive any raises or reductions in hours all play a role in this. It’s a really intricate computation that needs approval before it can be used. The anticipated payout duration for participants in this plan is 25 years. Income-Sensitive: Unlike some of the other alternatives discussed above, this one lacks a simple formula. In this situation, you should get in touch with the company that issued your loan(s) to find out how they determine the potential monthly payment amount. How long will it take for this plan to pay off student loans? 10 years . Important Information: If you combined your loans, the amount you borrowed will effect how quickly you pay them off. Examine the Federal Student Aid website for more details about that.

I realize that’s a lot of information, but it’s crucial to be aware of all of your alternatives. Remember that if a life event occurs that impacts your income or capacity to pay your obligations on time, you have the option to amend your repayment plan or submit an application for a deferment or forbearance. You should always let your lenders know about any of these difficulties before the past-due date arrives because defaulting on your debts could result, which you obviously don’t want to deal with.

SUCH AS PRIVATE STUDENT LOANS The water becomes a little bit muddy at this point. You may be required to pay back the loan for any period of time, though ideally not more than 25 years, depending on who provided the loan and the terms of their agreement.

Inquire with your lender if there are any penalties for paying off the loan early. Although it seems absurd, it does occur.

Keep copies of all your documents so you may refer to it anytime you have questions. That is one of the best pieces of advise I can give you. Call your lender and ask them to explain their policies if you can’t find the answer online. Keeping the lines of communication open is wise in case a problem arises later.

TIP: MAINTAIN ORGANIZED FINANCES

It’s time to organize your money now that you know how long it can take to pay off your student loans. To keep track of all your expenses and their due dates, I strongly advise creating some form of budget sheet. You may get budgeting worksheets that you can instantly download at the Study Sesh on Etsy to keep things organized.

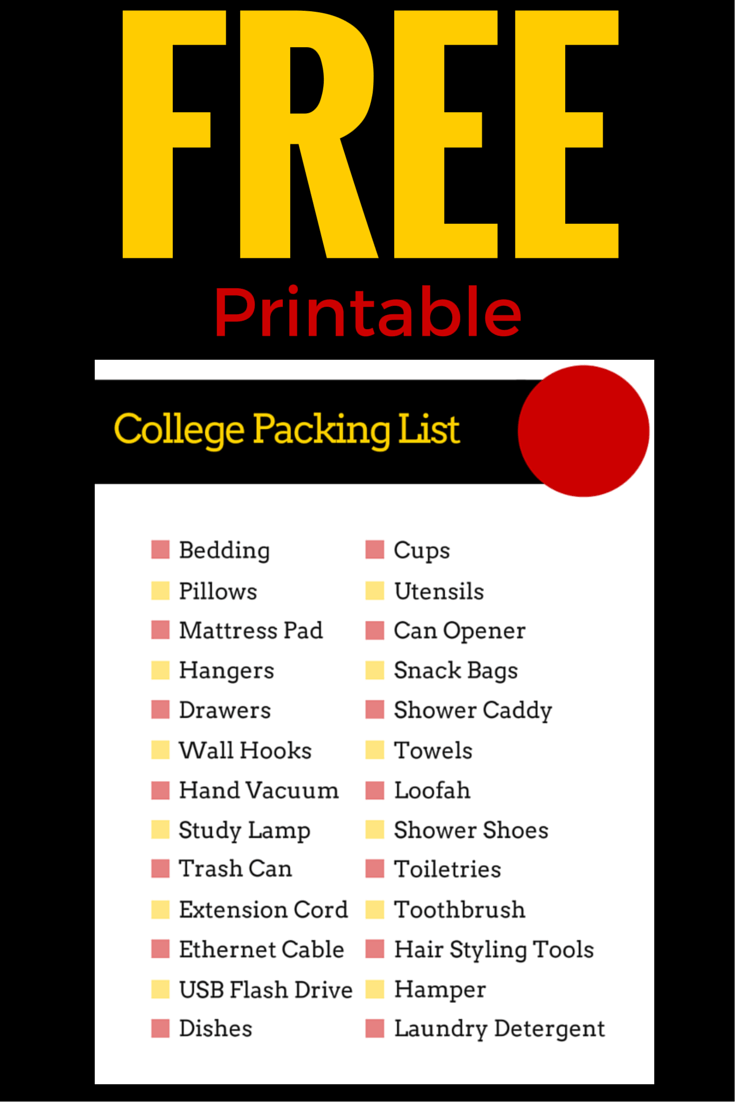

Here is a free budgeting printable set made particularly for college students who wish to start managing their money well.

If you can use a debt snowball tool or another money-saving technique—I know those loans look overwhelming and that 10 years seem like an eternity—do so! It might end up saving you a ton in interest fees!

What sound financial counsel would you give to someone who is paying off debt, whether it be credit card, student loan, or another kind?